Interest Rate-利率

A small amount of money now may be equivalent in value to a larger amount received at a future date.

一小笔现在的前,可能相当于未来某一时间的更大金额.

Interest rates are set in the marketplace by the forces of supply and demand.

利率在市场上由供求决定

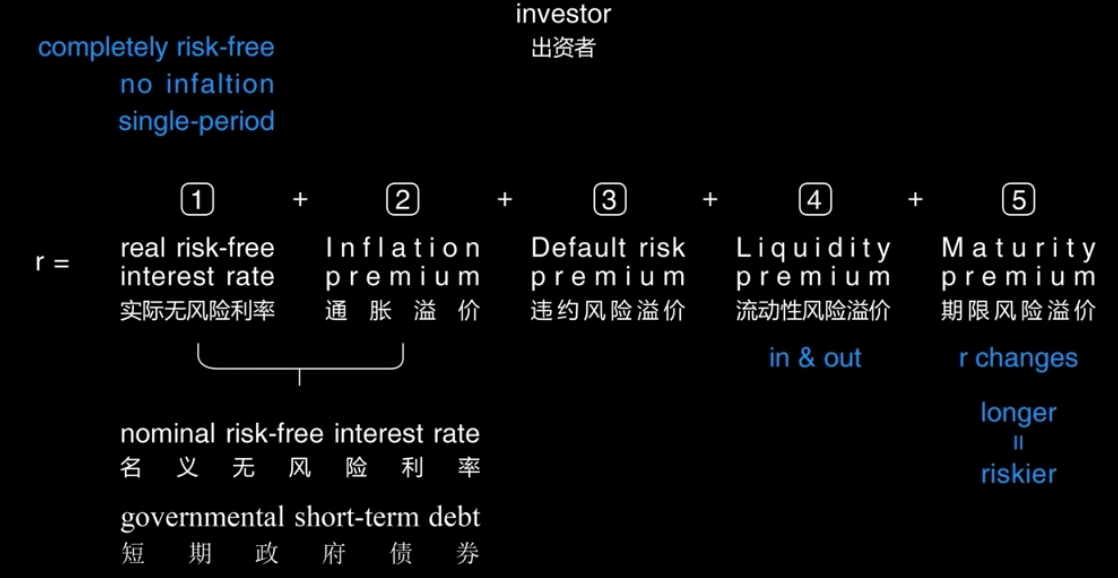

※一些短期政府债券也被视为名义无风险利率

※一些短期政府债券也被视为名义无风险利率

利率也被称为

- required rate of return-必要回报率

- discount rate-折现率

- opportunity cost-机会成本

opportunity cost is the value that investors forgo by choosing a particular course of action

机会成本是投资者选择了某个行为而放弃掉的价值

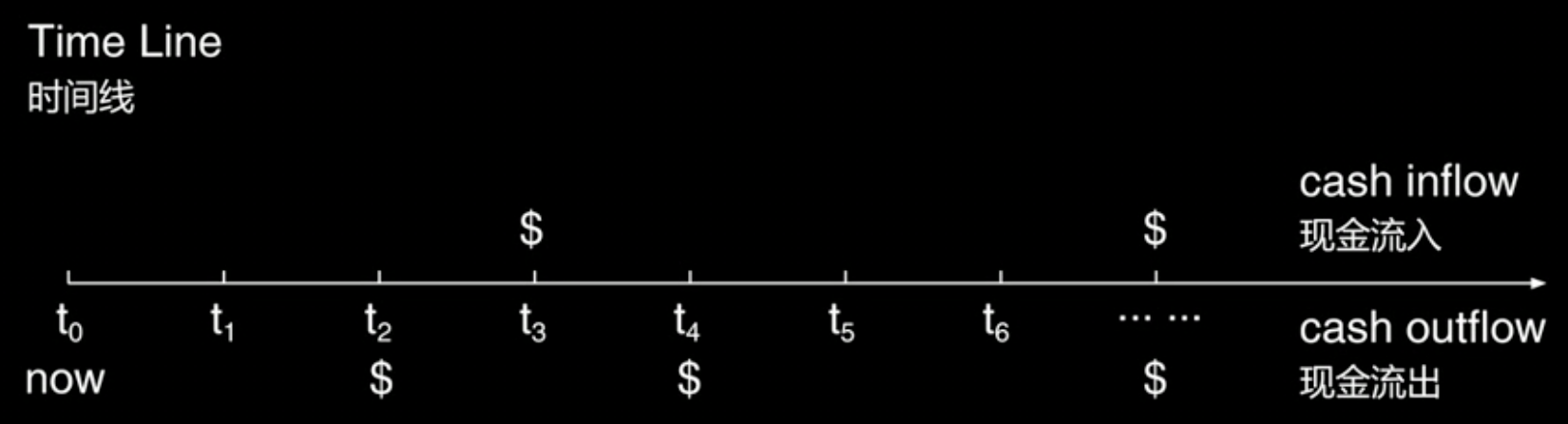

The time value of money-货币的时间价值

The time value of money as a topic in investment deals with equivalence relationships between cash flows with different rate

作为投资领域的一个概念,货币的时间价值处理的是不同日期之间的现金流的等价关系

※时间线上方出现的数字代表现金流入,下方出现的数字代表现金流出(不论带不带符号)

※时间线上方出现的数字代表现金流入,下方出现的数字代表现金流出(不论带不带符号)

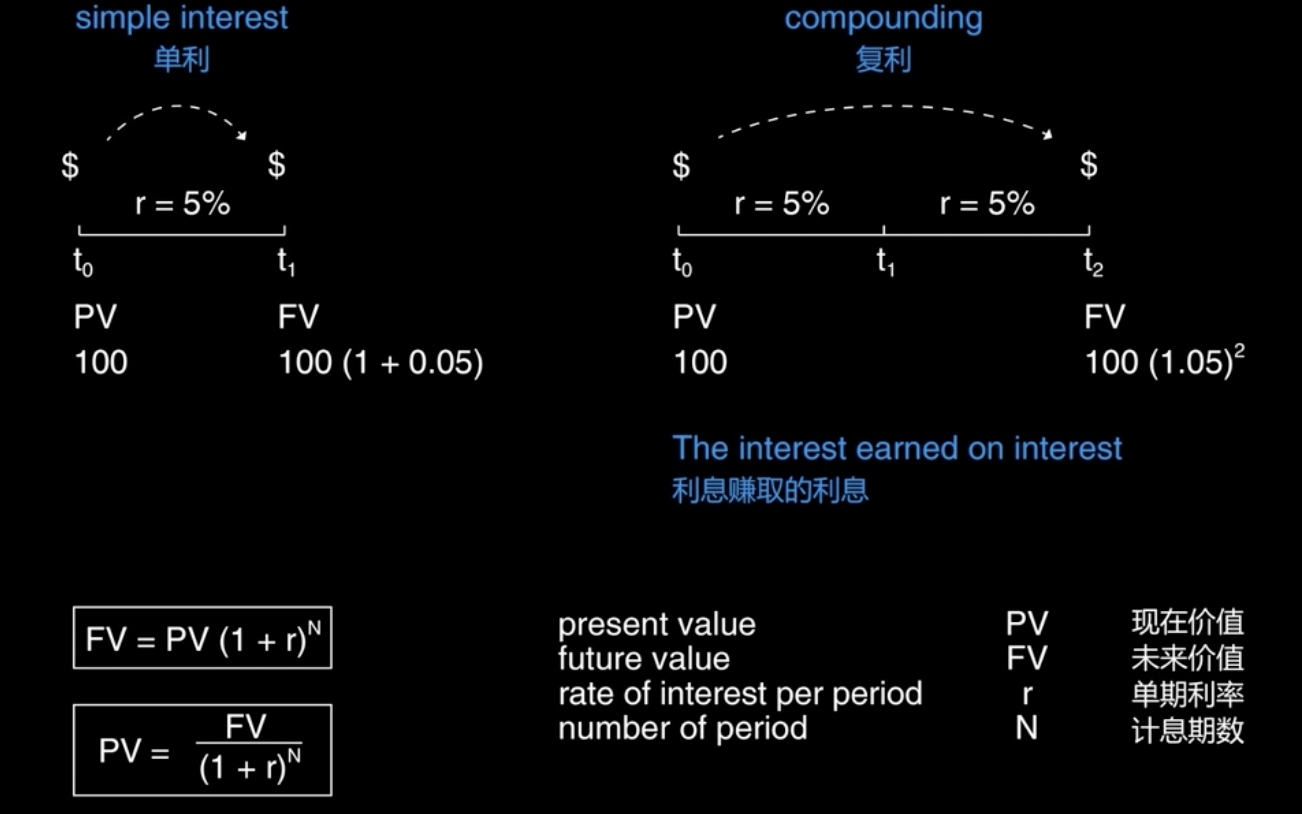

The Future Value of a Single Cash Flow-单一现金流的未来价值

Principle is the amount of funds originally invested

本金是最初的投资金额

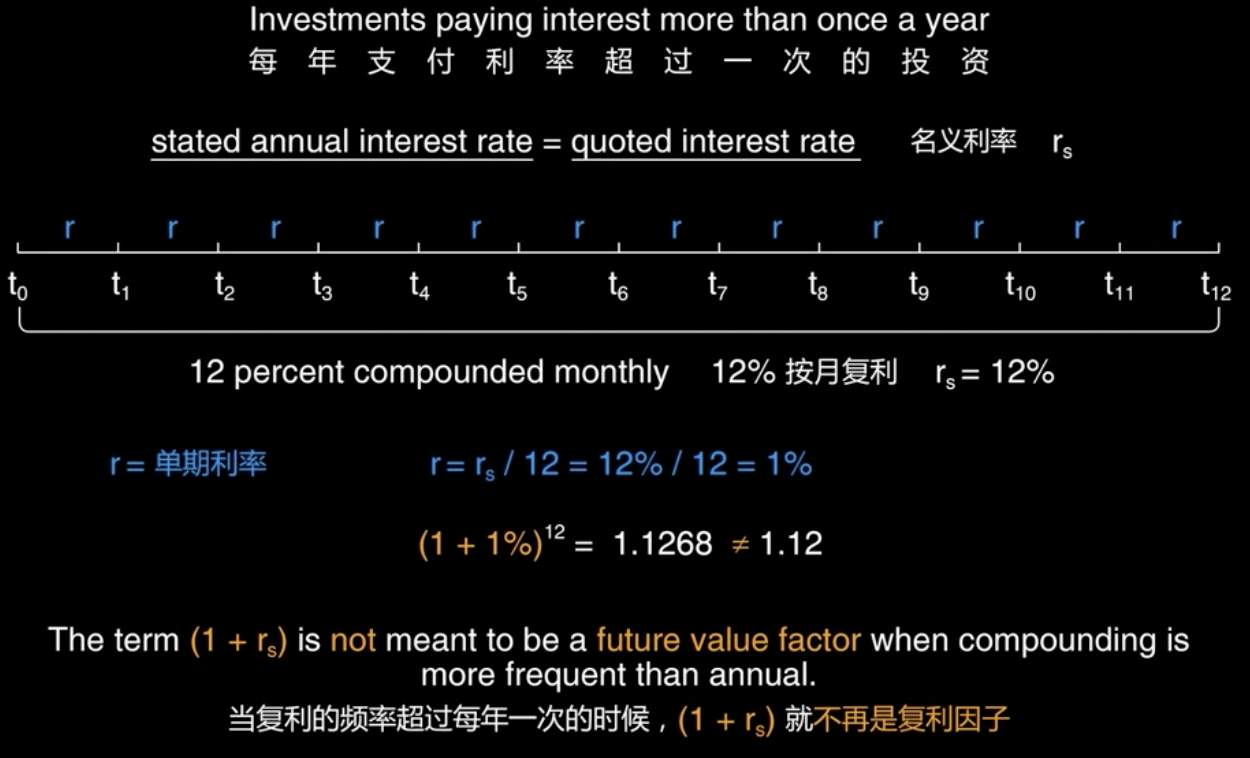

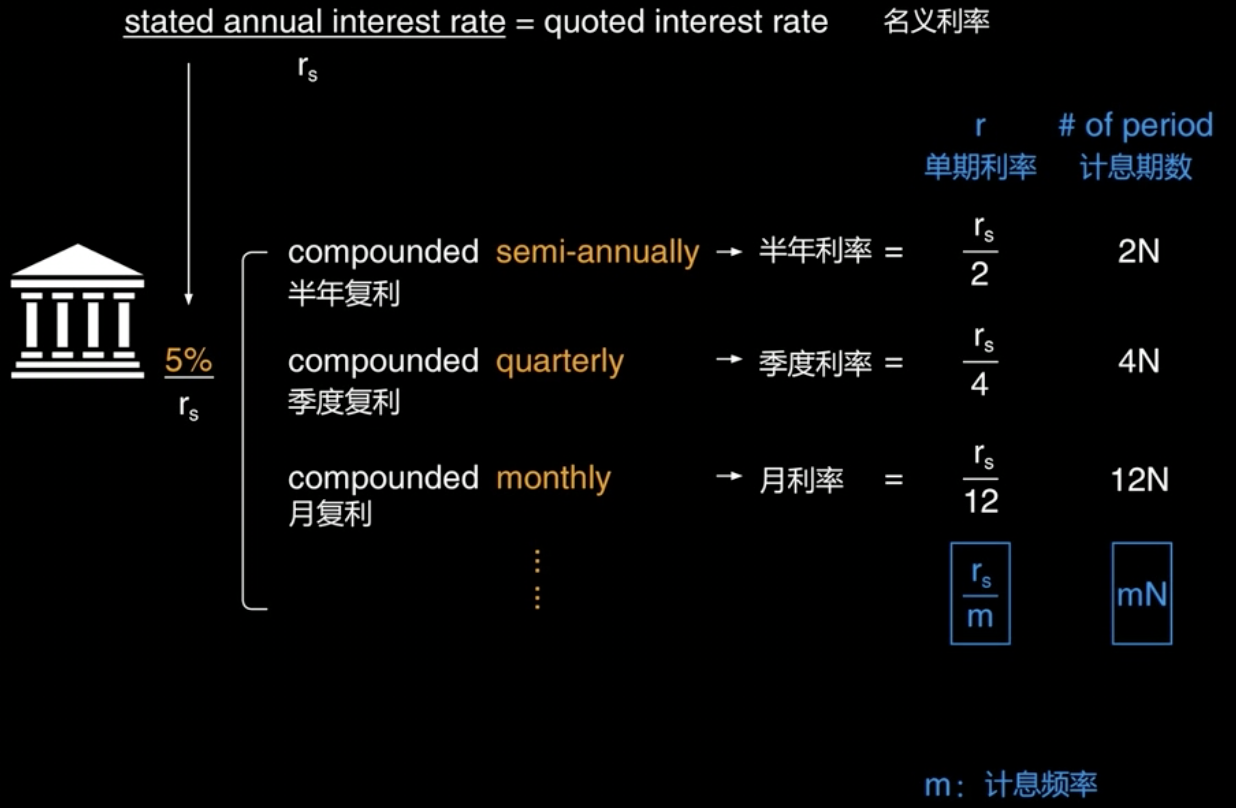

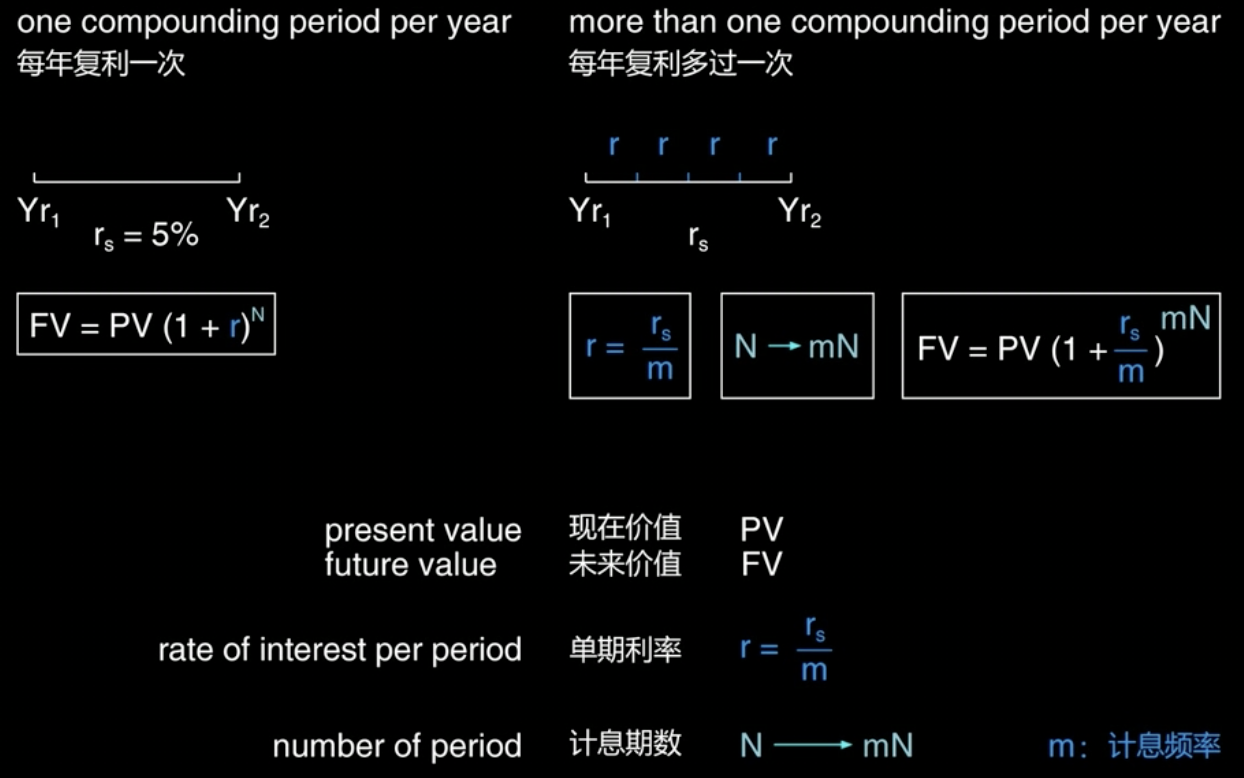

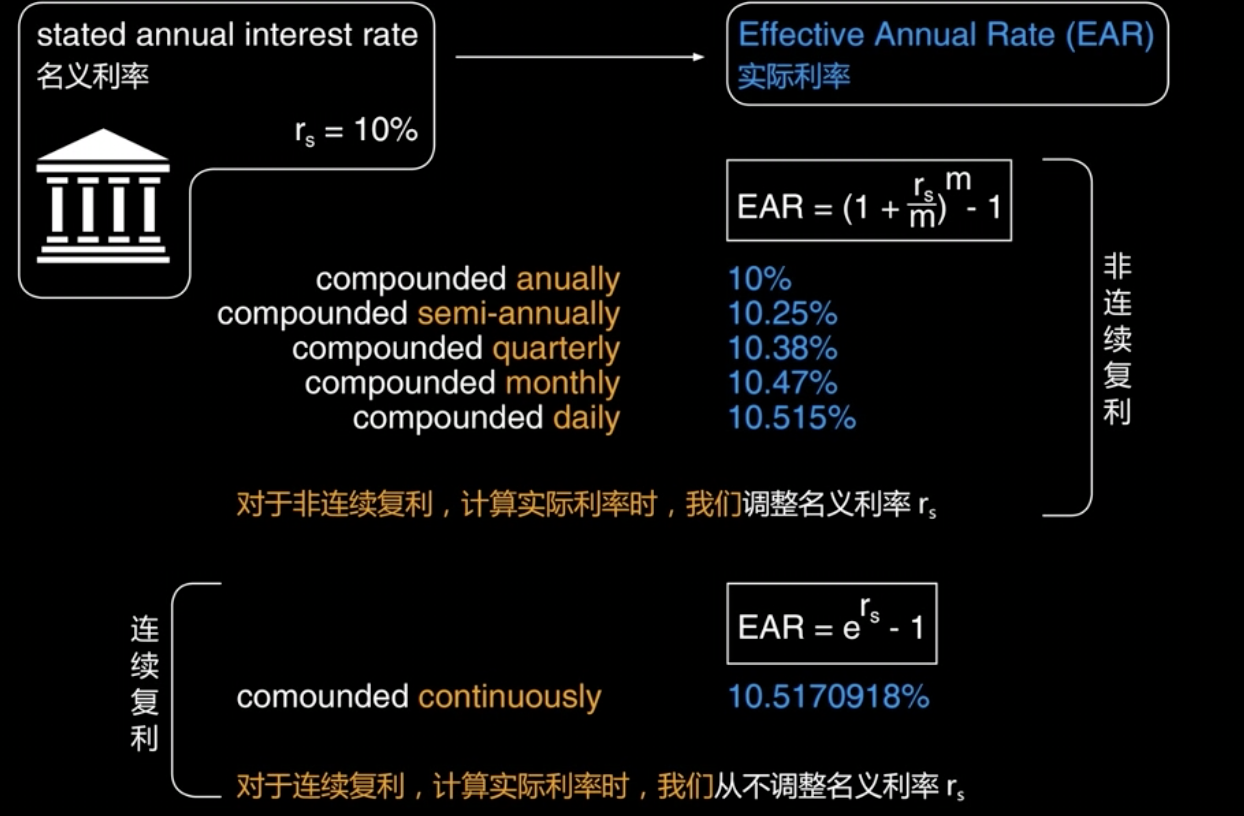

The Frequency of Compounding-复利的频率

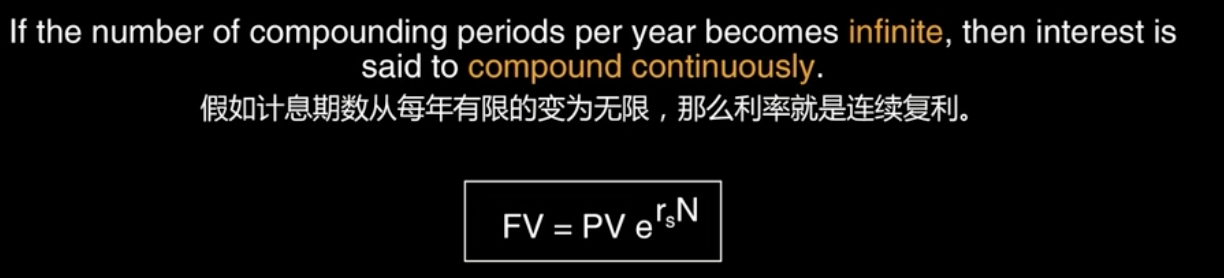

Continuous Compounding-连续复利

统计学中,数据分为

- continuous data 连续数据 (在一定区间内可以任意取值的数据叫连续数据。比如:体重:0.542..kg, 时间:1.234...s)

- discrete data 离散数据 (离散数据是指其数值只能用自然数或整数单位计算的数据。比如: 硬币:1个 学生:5个)

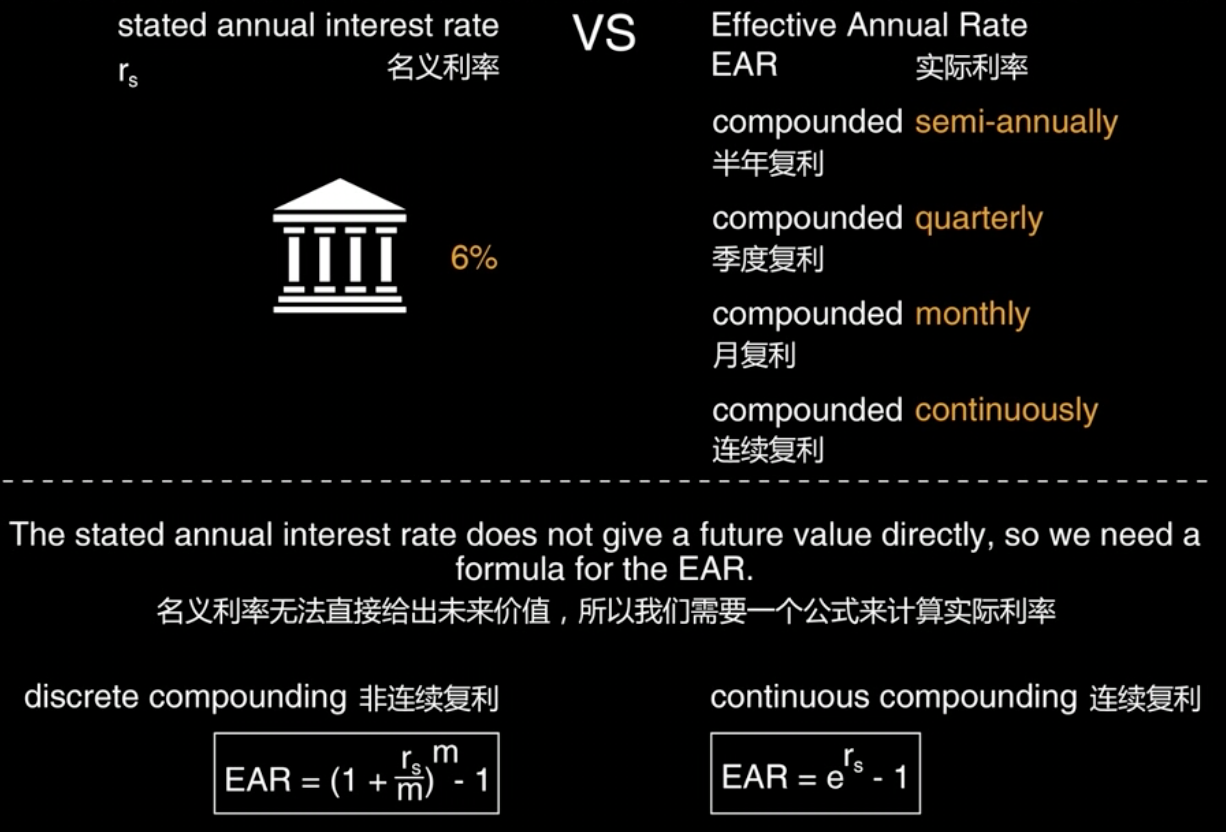

Stated and Effective Rates-名义利率和实际利率

假设名义利率为6%,计息期数为1年,根据计息频率

| Frequency | rate of interest per period | number of period | FV | |

|---|---|---|---|---|

| annually 每年 | 6% / 1 = 6% | 1 * 1 = 1 | 1.06 | 1.06 |

| semi-annually 每半年 | 6% / 2 = 3% | 2 * 1 = 2 | 1.03 ** 2 | 1.0609 |

| quarterly 每季度 | 6% / 4 = 1.5% | 4 * 1 = 4 | 1.015 ** 4 | 1.061364 |

| monthly 每月 | 6% / 12 = 0.5% | 12 * 1 = 12 | 1.005 ** 12 | 1.061678 |

| daily 每日 | 6% / 365 = 0.0164% | 365 * 1 = 365 | 1.00164 ** 365 | 1.061831 |

| continuously 连续 | 6% | 1 | e ** (0.06 * 1) | 1.061837 |

FV中的**2代表平方

This result leads us to a distinction between the stated annual interest rate and the effective annual rate(EAR)

这个结果引出我们要讨论的名义年利率和实际年利率的区别

Python代码实现

import numpy as np

class Quantitative:

def EAR_get(self,rs,m=None) -> float:

"""

获取实际利率(Effectice Annual Rate)

In:

rs: 名义利率

m: 计息频次, None代表连续计息

Out:

EAR:实际利率

"""

if not m:

ear = np.exp(rs) - 1

else:

ear = (1 + rs/m) ** m - 1

return rar

def fv_get(self,pv,rs,N,m=None) ->float:

"""

获取单一现金流的未来价值

In:

pv:现在价值

rs:名义利率

N:计息期数

m:计息频次,None代表连续计息

Out:

fv:未来价值

"""

ear = self.EAR_get(rs,m)

fv = pv * ((1+ear) ** N)

return fv